Soar incorporated is considering eliminating – Soar Incorporated is contemplating a pivotal decision: the elimination of a subsidiary entity. This decision holds significant implications across various aspects of the organization, from its structure and operations to its financial health and legal compliance. This comprehensive analysis delves into the potential impacts of this move, examining its effects on organizational structure, financial performance, day-to-day operations, and more.

The discussion explores alternative options to elimination, such as restructuring or merging, and provides a decision-making framework to guide Soar Incorporated’s leadership in their deliberations. The analysis concludes with a summary of the key considerations and potential outcomes, offering valuable insights for stakeholders.

Impacts on Company Structure

Eliminating an entity can have significant impacts on a company’s organizational structure. It can lead to changes in reporting relationships, decision-making processes, and overall operational efficiency.

For example, eliminating an entity could result in a more streamlined organizational structure with fewer layers of management. This could lead to faster decision-making and improved communication between different departments.

Financial Implications

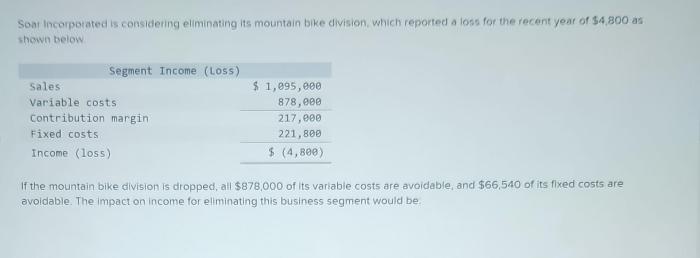

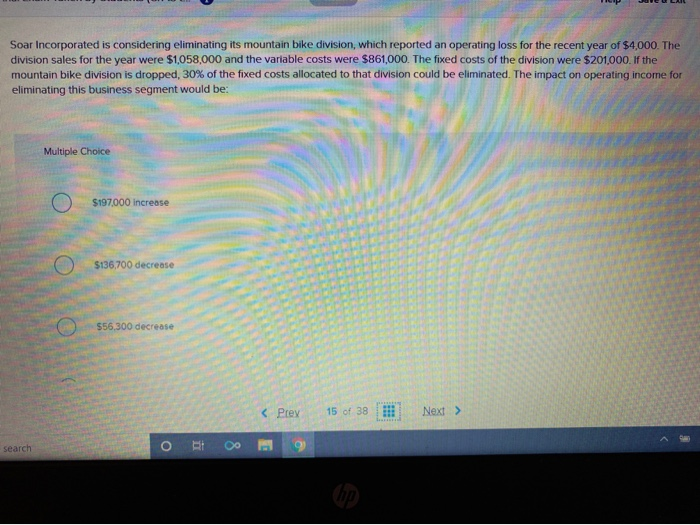

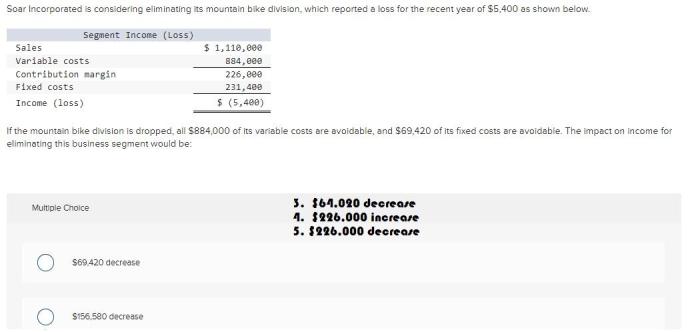

Eliminating an entity can also have significant financial implications. It can affect revenue, expenses, profitability, cash flow, debt levels, and return on investment.

For example, eliminating an entity could lead to a reduction in revenue if the entity was a major contributor to the company’s sales. It could also lead to a decrease in expenses if the entity was responsible for a significant portion of the company’s costs.

Operational Considerations

Eliminating an entity can also have an impact on day-to-day operations. It can affect customer service, supply chain management, and product development.

For example, eliminating an entity could lead to a decrease in customer satisfaction if the entity was responsible for providing customer support. It could also lead to disruptions in the supply chain if the entity was responsible for managing inventory or logistics.

Legal and Regulatory Implications, Soar incorporated is considering eliminating

Eliminating an entity can also have legal and regulatory implications. It is important to ensure that the elimination of the entity complies with all applicable laws and regulations.

For example, eliminating an entity could trigger certain tax liabilities. It could also affect the company’s compliance with corporate governance regulations.

Human Resources Considerations

Eliminating an entity can also have an impact on employees. It can affect job security, compensation, and benefits.

For example, eliminating an entity could lead to job losses if the entity was responsible for a significant portion of the company’s workforce. It could also lead to changes in compensation and benefits if the entity was responsible for providing certain employee benefits.

FAQ Section: Soar Incorporated Is Considering Eliminating

What are the potential financial implications of eliminating the entity?

The elimination could impact revenue, expenses, profitability, cash flow, debt levels, and return on investment.

How might the elimination affect day-to-day operations?

It could impact customer service, supply chain management, product development, efficiency, productivity, and customer satisfaction.