The ASC 842 weighted average discount rate (WADR) is a crucial component of lease accounting, providing a framework for determining the present value of future lease payments. This guide delves into the intricacies of WADR, exploring its significance, calculation methods, and implications under ASC 842.

The International Accounting Standards Board (IASB) introduced ASC 842 to enhance the transparency and comparability of lease accounting practices. This standard mandates the use of a WADR to discount future lease payments, ensuring a consistent approach to lease valuation.

1. Weighted Average Discount Rate (WADR)

The Weighted Average Discount Rate (WADR) is a crucial component in lease accounting. It represents the rate used to discount future cash flows associated with a lease obligation. Determining the appropriate WADR is essential for accurately reflecting the economic substance of a lease transaction.

The importance of WADR stems from its impact on the classification and measurement of lease liabilities and right-of-use assets. A higher WADR results in lower present values for future lease payments, leading to potentially lower lease liabilities and right-of-use assets.

2. ASC 842 and WADR

ASC 842, the new lease accounting standard issued by the Financial Accounting Standards Board (FASB), significantly revised the requirements for WADR. The key provisions of ASC 842 related to WADR include:

- WADR should be based on the incremental borrowing rate of the lessee.

- The incremental borrowing rate is the rate at which the lessee would borrow funds to obtain a similar asset or service.

- If the lessee cannot determine the incremental borrowing rate, they should use the rate implied in the lease.

- The WADR should be reassessed at the beginning of each reporting period.

3. Determining WADR

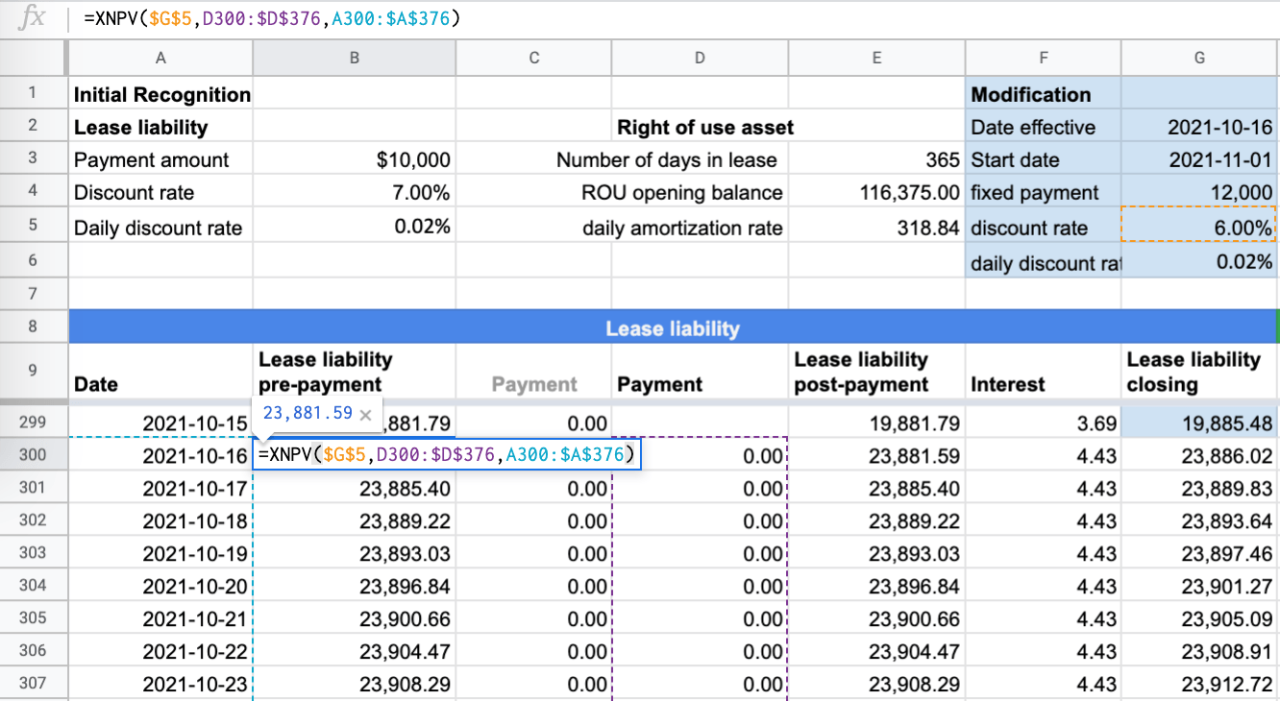

Determining WADR involves several steps:

- Identify the lease’s cash flows.

- Estimate the appropriate discount rate for each cash flow.

- Weight each discount rate by the present value of the associated cash flow.

- Calculate the weighted average of the discounted cash flows to arrive at the WADR.

4. Factors Affecting WADR, Asc 842 weighted average discount rate

Several factors can affect WADR, including:

- The lessee’s creditworthiness

- The term of the lease

- The interest rate environment

- The type of asset being leased

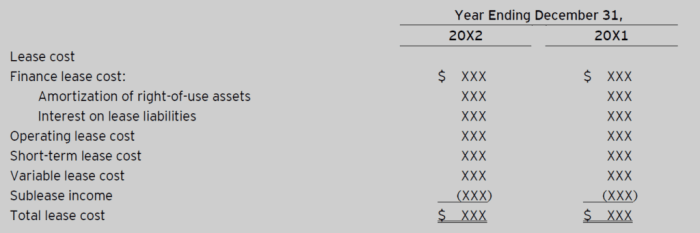

5. Documentation and Disclosure

ASC 842 requires lessees to document the WADR used in lease accounting. This documentation should include:

- The methodology used to determine the WADR

- The assumptions and estimates used in the calculation

- The source of the incremental borrowing rate

In addition, lessees must disclose the WADR used in their financial statements.

Helpful Answers: Asc 842 Weighted Average Discount Rate

What is the purpose of the WADR?

The WADR is used to determine the present value of future lease payments, which is essential for recording lease transactions on the balance sheet.

How is the WADR calculated?

The WADR is typically calculated as the average of the discount rates implicit in the market prices of similar debt instruments.

What are the key changes introduced by ASC 842 regarding WADR?

ASC 842 requires the use of a single WADR for all leases, regardless of their classification.