A transaction can be Everfi, a versatile platform that streamlines financial interactions with its comprehensive suite of features. From processing payments to generating reports, Everfi empowers businesses with the tools they need to manage their finances efficiently and securely.

Delve into the world of Everfi transactions, where convenience meets security. Discover the different types of transactions supported, the seamless processing mechanisms, and the robust security measures in place to safeguard your financial data. Whether you’re a seasoned business owner or just starting out, Everfi has the transaction solutions to meet your needs.

Everfi Transaction Definition

Within the context of Everfi, a transaction refers to any action or activity that involves the exchange of information, data, or resources between two or more entities within the Everfi platform.

These transactions can encompass a wide range of activities, including:

Types of Everfi Transactions

- User registration and account creation

- Course enrollment and completion

- Assessment submissions and grading

- Progress tracking and reporting

- Data sharing and collaboration

- Payment processing and invoicing

- Technical support and troubleshooting

Everfi Transaction Types

Everfi facilitates a diverse range of transactions, each serving specific purposes and possessing unique characteristics. These transaction types cater to various financial needs and requirements, enabling users to manage their finances efficiently.

Purchase Transactions

- Card Payments:Everfi allows users to make purchases using debit cards, credit cards, and prepaid cards. These transactions are typically processed in real-time and involve the transfer of funds from the user’s account to the merchant’s account.

- Online Banking Payments:Users can initiate payments through Everfi’s online banking platform. This method involves transferring funds from the user’s Everfi account to the recipient’s account, either within Everfi or to an external bank account.

- Mobile Payments:Everfi offers mobile payment options through its mobile app. Users can make purchases and send money using their smartphones, providing convenience and accessibility.

Transfer Transactions

- Internal Transfers:Everfi enables users to transfer funds between their own accounts within the platform. These transfers are typically instant and facilitate easy management of funds across different accounts.

- External Transfers:Users can transfer funds to bank accounts outside of Everfi. These transactions may take longer to process, depending on the recipient’s bank and the transfer method used.

- International Transfers:Everfi supports international money transfers, allowing users to send funds to recipients in other countries. These transactions may involve additional fees and may take longer to process.

Other Transaction Types

- Bill Payments:Everfi offers bill payment services, enabling users to pay their bills conveniently and on time. Users can set up automatic payments or make one-time payments for various bills, such as utilities, rent, and subscriptions.

- Investments:Everfi provides investment options, allowing users to invest their funds in a range of financial instruments, such as stocks, bonds, and mutual funds. These transactions facilitate wealth management and long-term financial growth.

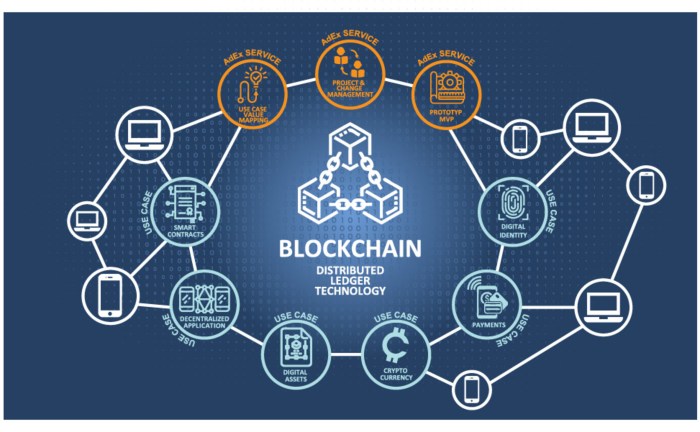

- Cryptocurrency Transactions:Everfi supports cryptocurrency transactions, allowing users to buy, sell, and hold cryptocurrencies. These transactions provide access to the growing digital currency market.

Everfi Transaction Processing

Everfi transaction processing involves a series of steps that ensure the secure and efficient initiation, authorization, and settlement of transactions within the Everfi platform. This process is crucial for maintaining the integrity and reliability of the Everfi ecosystem.

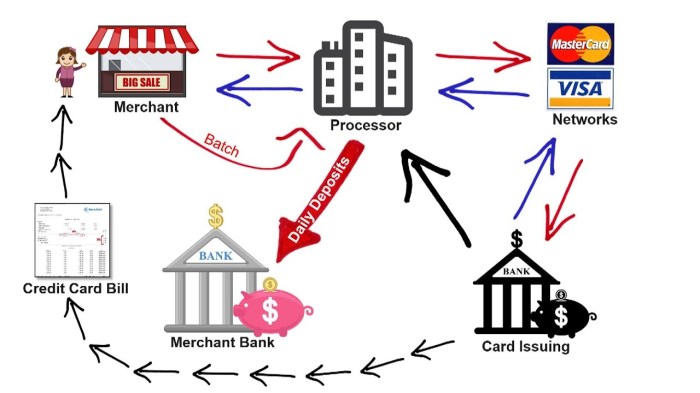

The transaction processing flow within Everfi typically involves the following key steps:

Authorization

When a user initiates a transaction on the Everfi platform, the first step is to obtain authorization from the relevant payment gateway. This involves verifying the user’s payment credentials, such as credit card or bank account information, and ensuring that the user has sufficient funds to complete the transaction.

Processing

Once the transaction is authorized, it enters the processing stage. During this stage, the transaction details are validated, and the necessary checks are performed to ensure compliance with applicable regulations and fraud prevention measures.

Settlement

The final stage of the transaction process is settlement. This involves transferring the funds from the user’s account to the merchant’s account. Settlement typically occurs within a predetermined timeframe, which may vary depending on the payment method and the specific Everfi policies.

Everfi Transaction Security

Everfi prioritizes the protection of transactions within its platform. Robust security measures have been implemented to ensure the confidentiality, integrity, and availability of transaction data.

To safeguard transactions, Everfi employs advanced encryption methods. Data is encrypted both at rest and in transit, using industry-standard algorithms such as AES-256. This encryption process renders data unreadable to unauthorized parties, protecting sensitive information from potential breaches or unauthorized access.

Fraud Prevention, A transaction can be everfi

Everfi has implemented comprehensive fraud prevention measures to minimize the risk of fraudulent transactions. These measures include:

- Real-time fraud detection algorithms that monitor transactions for suspicious patterns and flag potentially fraudulent activities.

- Advanced authentication mechanisms, such as two-factor authentication, to verify the identity of users initiating transactions.

- Collaboration with third-party fraud prevention providers to leverage industry-leading fraud detection tools and expertise.

Compliance with Industry Standards

Everfi adheres to the highest industry standards for transaction security. The platform is compliant with the Payment Card Industry Data Security Standard (PCI DSS), which sets rigorous requirements for protecting cardholder data. Regular audits and assessments are conducted to ensure ongoing compliance and maintain the highest level of security.

Everfi Transaction Reporting: A Transaction Can Be Everfi

Everfi offers comprehensive reporting capabilities to provide insights into transaction activities.

These reports enable users to track, analyze, and manage transactions effectively.

Transactions can be confusing, especially when they involve multiple steps or technical jargon. To make things easier, consider using an Everfi course. These courses are designed to simplify complex topics, including thoát vị đĩa đệm tiếng anh . With Everfi, you can break down even the most intricate transactions into manageable chunks.

Transaction Details Report

- Provides a detailed breakdown of individual transactions, including transaction ID, date, amount, status, and associated details.

- Useful for auditing purposes and identifying specific transactions for further investigation.

Transaction Summary Report

- Summarizes transaction activity over a specified period, grouped by date, transaction type, or other relevant criteria.

- Helps identify trends, patterns, and potential areas for improvement in transaction processing.

Reconciliation Report

- Compares Everfi transaction data with external sources, such as bank statements or accounting systems.

- Ensures the accuracy and completeness of transaction records and identifies any discrepancies.

Exception Report

- Highlights transactions that deviate from predefined rules or thresholds.

- Alerts users to potential fraud, errors, or other issues requiring attention.

Custom Reports

- Allows users to create customized reports based on specific criteria or data fields.

- Provides flexibility to extract and analyze transaction data tailored to specific business needs.

Everfi Transaction Fees

When processing transactions through Everfi, there are associated fees to consider. These fees vary depending on the type of transaction and the payment method used. Understanding the fee structure is crucial for budgeting and managing transaction costs effectively.

Everfi’s transaction fees are calculated based on a combination of factors, including the transaction amount, payment method, and processing volume. Fees are typically applied at the time of transaction and may be charged to either the sender or the recipient.

Transaction Fee Structure

- Credit Card Transactions:Fees for credit card transactions vary based on the card type, processing volume, and interchange rates. Typically, fees range from 1.5% to 3% of the transaction amount.

- Debit Card Transactions:Debit card transactions generally incur lower fees compared to credit cards, ranging from 0.5% to 2% of the transaction amount.

- ACH Transfers:ACH transfers, which are electronic transfers between bank accounts, typically have flat fees ranging from $0.25 to $1.00 per transaction.

- International Transactions:International transactions may incur additional fees, such as currency conversion fees and cross-border transfer fees.

Fee Calculation and Application

Everfi’s fee calculation process is transparent, and merchants can access real-time fee estimates before completing a transaction. The fees are applied at the time of transaction and may be deducted from the sender’s or recipient’s account, depending on the transaction type and payment method used.

Everfi Transaction Integration

Everfi offers a comprehensive suite of APIs and protocols to facilitate the seamless integration of its transaction processing capabilities with external systems. This enables businesses to leverage Everfi’s robust infrastructure and streamline their transaction management processes.

The available APIs cover a wide range of functionality, including transaction initiation, status tracking, and reporting. They support various protocols, such as RESTful APIs and webhooks, ensuring compatibility with a diverse range of systems and programming languages.

API Integration

Integrating with Everfi’s APIs is straightforward and well-documented. Developers can access detailed documentation, code samples, and support resources to guide them through the integration process. The APIs are designed to be flexible and customizable, allowing businesses to tailor the integration to their specific needs.

Security and Compliance

Everfi adheres to the highest standards of security and compliance. Its transaction processing infrastructure is PCI DSS Level 1 certified, ensuring the protection of sensitive financial data. Additionally, Everfi complies with various industry regulations, such as GDPR and CCPA, providing businesses with peace of mind regarding data privacy and protection.

Essential Questionnaire

What types of transactions can be processed through Everfi?

Everfi supports a wide range of transactions, including payments, refunds, chargebacks, and recurring payments.

How does Everfi ensure the security of transactions?

Everfi employs industry-standard encryption methods, fraud prevention measures, and compliance with PCI DSS to safeguard transaction data.

Can Everfi be integrated with external systems?

Yes, Everfi offers APIs and protocols for seamless integration with external systems, enabling businesses to streamline their financial operations.